Washington State Governor Bob Ferguson signed House Bill 1217 in May 2025. This bill is known as the “Washington State Rent Control Bill” or the “Washington State Rent Stabilization Bill.” It’s part of a suite of bills addressing affordable housing in Washington, targeting stability for Washington families.

Governor Ferguson stressed the urgent need for affordable housing in Washington. He said these bills will help make building all types of housing easier, quicker, and cheaper.

One of the biggest changes is the new rent increase limits, which are based on the 12-month percent change in the Consumer Price Index. This index covers all items for urban consumers in the Seattle area. It is published by the United States Bureau of Labor Statistics.

Here are key points to know as a landlord:

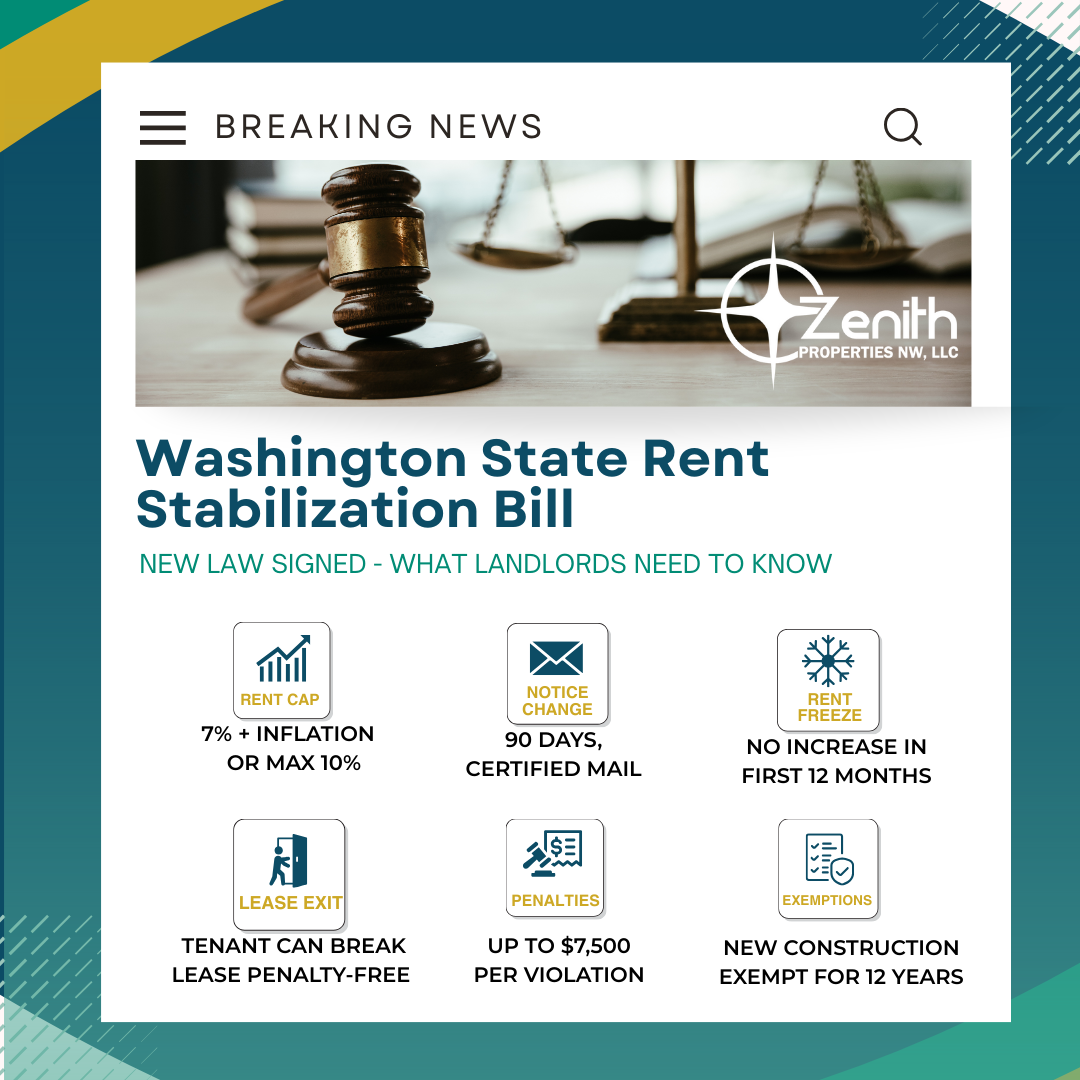

- It caps rent increases for existing tenants at 7% plus the Consumer Price Index or 10% (whichever is lower).

- At the same time, landlords can raise rent even more for new tenants.

- Additionally, the bill limits rent increases for manufactured homes to 5%.

- The WA Department of Commerce confirms that the maximum annual rent increase is 10.0% until December 31st, 2025.

- The maximum rent increase percentage for 2026 will be announced soon. This data is expected from the U.S. Bureau of Labor Statistics by the end of July 2025.

HB 1217 brings new changes to landlord-tenant rules. It focuses on more transparency and protections for tenants. But what should you anticipate if you’re renting out your property in Washington?

Biggest Changes in Bill HB 1217

- First-Year Rent Freeze: Rent increases are prohibited during the first 12 months of a tenancy. After the first 12 months, rent can be increased.

- Rent Increase Cap: Annual rent increases are limited to the lesser of 7% plus the Consumer Price Index or 10%, whichever is lower. This cap affects most rental properties. It includes single-family homes owned by corporations, LLCs, or REITs.

- Notice Requirements: Landlords must give written notice 90 days before increasing rent. Previously, you only needed to provide a 60-day written notice. The method for sending any notice now also has to be changed. Previously, you needed to deliver via personal delivery and First-Class mail. Now, you must deliver all notices via personal delivery and now Certified Mail.

- Lease Termination Rights: Tenants can end their lease with 20 days’ notice if a rent hike goes over the legal limit. There’s no penalty for breaking the lease.

- Enforcement and Penalties: Tenants or the Washington Attorney General can take legal action for violations. Penalties may include actual damages, up to three months’ rent, and attorneys’ fees. The Attorney General can recover up to $7,500 per violation.

- Exemptions: New construction rentals are exempt from the cap for 12 years after completion.

This law is taking immediate effect. A professional property manager must update their processes to comply with the new law. Below are examples of how Zenith Properties is changing our processes.

Changes to Zenith Processes:

- Training: Our team is getting complete training on this bill. We are using key resources like our legal reps and the National Association of Rental Property Managers (NARPM).

- Notice Requirements: We are updating the notice language to be in compliance with the law. We will begin sending all notices through certified mail. Our processes have been updated to keep proper documentation in our system.

- Bi-Annual Evaluations: We used to evaluate the property at 90 days of tenancy. Now, we will start scheduling evaluations at 120 days. We want to make sure that an evaluation of the property is done prior to sending the lease renewal.

- Lease Renewal: We will start sending lease renewals ahead of the 90-day requirement. Our forms have been updated with the correct language as advised by our council. Additionally, we have our resources updating our lease to further be in compliance.

- Communication: We understand that this transition will bring up questions for our clients and tenants. Our team will be fully prepared to provide support for any questions that arise. You can confidently reach out to your Portfolio Manager for any questions you have.

For a comprehensive overview of HB 1217, you can refer to the official bill summary here.

Why This Matters

Laws like HB 1217 are why you need a good property management team. They can respond quickly to changes and protect your interests. A professional property manager, such as Zenith Properties, shields you from legal risks. We also help protect your income and keep your investments compliant and performing well.

Reach out to our team today if you have any additional questions. You can also check out our resource library here for more information on managing rental properties in WA state.